Path to $1,000,000+

March 3, 2021

Would you pay $10,000 today in return for $1,000,000 tomorrow?

Easy question, right? Not exactly...

If you invested $10,000 in a company today and the share price dropped 50%, it's not so easy to stomach the drop. However, if any lessons have been learned, those lessons of wealth creation are often discovered with the power of patience.

2020 was an unpredictable year but the fundamentals of investing remained the same. The fundamentals such as:

1. Buy companies that you understand

2. Wait patiently for the share price to reflect the company's true value

3. Focus on companies with growing revenue, low debt/restructuring of debt then allow compound interest to work in your favor

Sounds simple but so many investors get caught up in the news and price targets and the list goes on that the fundamentals are lost and so are the potential profits.

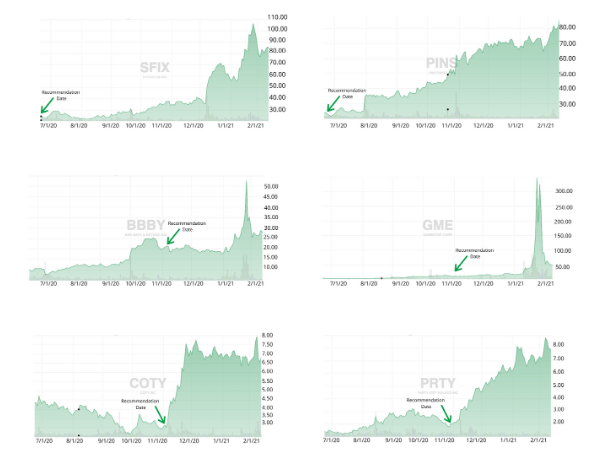

Did you know 10,000 shares or a combination of any the companies featured in the charts is worth a minimum of $100,000 -$1,000,000 today. If you had bought 10,000 shares of Pinterest, Stitch Fix or GameStop when we first recommended them to members here and held until January, then you would be looking at $1,000,000 in your investment portfolio in less that a 12 month period. Wow!

That should be exciting, right?

Patience is POWER

(<= watch this $$$)

If you watched the video above, I hope you can feel the energy because there is so much power in patience.

And if you're still not convinced, keep reading...

If you had bought Coty at $2.89 and held on to it, your initial investment would have more than doubled.

If you had $5,000 (732 shares) invested in Gamestop at $6.83 when we first recommended it in September and sold at its peak then your portfolio would have increased 50-fold by selling in January at it peak.

Coty and Gamestop while profitable in different ways show two important sides of holding and selling. With Coty, it is a growing company that is below its intrinsic value. So it would be a great example of staying the course with the power of patience.

On the other hand, when Gamestop grew to over 3,000% this was a quick win and a lesson from Warren Buffett "Be fearful when others are greedy".

Cue the confetti: TIME TO SELL!

Companies trading well above their intrinsic value can be dangerous territory especially when you're unsure of where the top may be.

Essentially, buying and holding is equally as important as knowing when to exit.

Check out the Stock Up Guide

we provided to Members in November 2020 as you continue your investing journey because the best investment advice ever received is that "PATIENCE IS POWER."

Bitcoin mining companies play a pivotal role in the dynamic landscape of cryptocurrency. These firms dedicate substantial resources, cutting-edge technology, and formidable expertise to harness the cryptographic puzzles that validate and secure the Bitcoin network. Through powerful mining rigs and sophisticated algorithms, these companies compete to solve complex mathematical equations, earning Bitcoin rewards in the process. Here's a breakdown of what a Bitcoin mining company typically does: Hardware Acquisition and Setup: Bitcoin mining companies acquire specialized computer hardware known as mining rigs or ASICs (Application-Specific Integrated Circuits). These rigs are specifically designed to solve complex mathematical puzzles required to validate transactions on the Bitcoin blockchain. The company sets up these rigs in data centers or facilities with adequate cooling and electricity infrastructure. Mining Operations: Once the hardware is set up, the mining company connects its rigs to the Bitcoin network. Miners use their computational power to solve complex mathematical problems, a process known as mining. This involves verifying and bundling transactions into blocks, adding them to the blockchain, and securing the network. Miners compete to solve these mathematical puzzles, and the first miner to solve the puzzle and add a new block of transactions to the blockchain receives a reward in Bitcoin. Maintaining and Upgrading Equipment: Mining hardware requires regular maintenance, including cleaning, hardware checks, and upgrades to ensure optimal performance. As the mining difficulty increases (due to more miners joining the network), mining companies might need to upgrade their equipment or expand their operations to remain competitive. Electricity and Operational Costs: Bitcoin mining is energy-intensive. Mining companies need to manage electricity costs, which can be a significant part of their operational expenses. Companies often seek locations with cheap and reliable electricity to maximize profitability. Transaction Fees and Revenue Generation: In addition to mining rewards (newly minted Bitcoins), miners also earn transaction fees from the transactions they include in the blocks they mine. These fees contribute to the revenue of Bitcoin mining companies. Compliance and Regulatory Adherence: Mining companies must navigate regulatory frameworks and comply with legal requirements in the jurisdictions where they operate. This includes adhering to tax regulations, environmental standards, and other compliance measures. Innovation and Research: Many mining companies invest in research and development to improve mining efficiency, reduce energy consumption, and develop new technologies that enhance their mining capabilities. Overall, Bitcoin mining companies play a crucial role in the decentralized network by contributing computational power to secure the blockchain and facilitating the creation and circulation of new Bitcoins. They form the backbone of the decentralized system, ensuring transaction authenticity and network integrity. In an ever-evolving industry, these companies continuously innovate, striving for greater efficiency and sustainability while shaping the future of digital finance through their unwavering commitment to the mining ecosystem.

Whole life insurance isn't just a safeguard for your loved ones in the event of your passing. It can be a versatile asset that you can leverage during your lifetime to meet various financial goals and needs. By accumulating cash value, enjoying tax benefits, and utilizing policy loans, you can make whole life insurance an essential part of your financial strategy. When used wisely, it can provide financial security and peace of mind both now and in the future.

Earnings Season is upon us and it’s a crucial period in the financial world, during which publicly traded companies release their quarterly financial reports and this event is important for several reasons: Investor Expectations: Earnings season provides us with a regular opportunity to gauge how well a company is performing. The market often reacts to these reports, causing stock prices to rise or fall based on whether a company met, exceeded, or missed expectations. Stock Price Movement: The financial results and guidance provided during earnings season can significantly impact a company's stock price. Positive results can lead to an increase in stock value, while negative results can result in a decline. This can create trading opportunities for us. Evaluation and Analysis: Earnings reports provide essential data for fundamental analysis. You can use the provided information to assess a company's financial health, growth prospects, and valuation. Basically it can assist you in making informed investment decisions. Economic Barometer: Earnings season gives you insight into the broader economy. If a majority of companies report strong earnings and positive outlooks, it can be a sign of a healthy economy. Conversely, poor earnings across the board may indicate economic challenges. Company Strategy and Performance: Earnings reports often include management discussions, which can reveal a company's strategies, challenges, and future plans. This information is valuable for understanding a company's long-term prospects. Market Volatility: Earnings season tends to increase market volatility, as traders and speculators attempt to profit from short-term price movements and increased trading volumes. Benchmark for Companies: Companies are often measured against their peers and industry averages during earnings season. It's an opportunity for companies to prove themselves and differentiate from their competitors. Guidance for Investors: Earnings reports often include guidance for the upcoming quarter or year, which can be instrumental in setting expectations and helping you make decisions about your holdings. In summary, earnings season is a crucial time for investors, analysts, and financial professionals to assess the health and performance of publicly traded companies. It provides a wealth of information that can impact stock prices, influence investment decisions, and offer insights into the broader economy.

If you follow the market, I'm sure you regularly hear the media reference market volatility. However, have you ever wondered what this truly entails. Well, let's talk about it....market volatility refers to the degree of variation in the price of a financial instrument or the overall market over time. It is a measure of how much the price of an asset or market index fluctuates. Higher volatility indicates that the prices are fluctuating rapidly and by larger amounts, while lower volatility means prices are relatively stable and don't change as dramatically. A couple key points about market volatility: Causes of Volatility: Market volatility can be caused by a variety of factors, including economic data releases, geopolitical events, changes in interest rates, corporate earnings reports, and unexpected news or events. Volatility Index: The most well-known measure of market volatility is the CBOE Volatility Index, commonly known as the VIX. It is often referred to as the "fear gauge" and is used to assess investor sentiment and expectations about future market volatility. Types of Volatility: There are two main types of market volatility: Historical Volatility: This looks at past price movements and measures how much an asset has fluctuated over a specific period. Implied Volatility: This is derived from options pricing and reflects market expectations about future price fluctuations. High implied volatility suggests that traders anticipate greater price swings. Impact on Investments: Volatility can have a significant impact on investments. While higher volatility can provide opportunities to take profit from price swings, it can also increase risk. Long-term investors may find periods of high volatility unsettling, but they should remember that markets tend to have upward trends over the long run. Risk Management: Managing risk in a volatile market is essential. Diversification, using stop-loss orders, and having a clear investment strategy can help protect your portfolio during periods of high volatility. Volatility Trading: Options trading is a method that can be used for hedging or speculation during volatile times. Market Sentiment: Public sentiment and investor behavior can contribute to market volatility. Panic selling or irrational exuberance can exaggerate price swings. Government and Central Bank Policies: Economic policies, interest rate changes, and central bank actions can influence market volatility. For example, the interest rate hikes of which we are currently experiencing affect the cost of borrowing and the attractiveness of different asset classes. However, market volatility is a normal part of financial markets. While it can create opportunities, it also presents risks. Investors and traders should be aware of these dynamics and adapt their strategies accordingly, whether their goal is capitalizing on volatility or preserving capital during turbulent times.

Are we witnessing the development of a new world order? Think about it...1)Currency Devaluation, 2) Increasing Wealth Disparity and 3) Global Warfare. These are three of the most pressing questions shaping our world today. We must give our attention to the intricate web of international relations, economic dynamics, and societal shifts occurring before our eyes. Did you know? Currency devaluation is the deliberate reduction in the value of a nation's currency and is a multifaceted issue with global implications, as it often raises questions such as: Why do countries devalue their currencies?** Governments may devalue their currency to boost exports, reduce trade deficits, or make foreign debt payments more manageable. What is the impact on global trade?** Currency devaluation can affect the competitiveness of a nation's exports, influencing global trade dynamics. What are the risks and consequences?** Devaluation can lead to inflation, impacting the purchasing power of citizens and the confidence of international investors regarding our economy. Did you know? Wealth disparity is a growing concern in many societies. Some pertinent questions include: What causes wealth inequality?** Factors like unequal access to education, job opportunities, and social safety nets. What is the impact on societies?** High wealth disparity can lead to social unrest, reduced social mobility, and hindered economic growth. Are there any solutions:** Governments, businesses, and individuals are exploring various approaches to address wealth disparity, from progressive taxation to philanthropy. A war has already begun. Global conflicts continue to shape the world order, prompting questions such as: What drives global conflicts?** Root causes can vary from territorial disputes, to ideological differences or access to resources. What is the impact on our lives?** Conflicts have devastating consequences, leading to displacement, loss of life, and long-term instability. How can we resolve these conflicts?** Diplomatic efforts, peacekeeping missions, and international cooperation play pivotal roles in resolving conflicts and maintaining global stability. It's important to recognize that these issues are interconnected. Currency devaluation can exacerbate wealth disparity, which in turn, may contribute to social unrest and conflicts. Understanding these interdependencies is crucial in shaping a more stable and equitable world.

1. Adding Options Trading to Your Brokerage Account: a. Log in to your brokerage account. b. Navigate to the account settings or preferences section. c. Look for an option to enable options trading. d. Follow the prompts and provide any necessary information. e. Review and accept the terms and conditions. f. Once approved, you should have access to options trading features. 2. Understanding Options Contracts: An options contract is a financial instrument that gives you the right, but not the obligation, to buy or sell a specific asset (such as stocks) at a predetermined price (strike price) within a certain timeframe (expiration date). There are two types of options contracts: call options and put options. 3. Exploring Call Options and Profiting from Rising Stocks: a. A call option is an options contract that gives the holder the right to buy the underlying asset (stock) at the strike price before the expiration date. b. To profit from a rising stock using call options: i. Identify a stock you believe will increase in price. ii. Determine the strike price and expiration date for your call option. iii. Purchase a call option for the chosen stock. iv. If the stock price rises above the strike price before the expiration date, you can exercise the option or sell it for a profit. v. If the stock price does not rise as anticipated, you may lose the premium paid for the call option. *Remember, options trading involves risks, and it's essential to educate yourself thoroughly before engaging in this type of trading. Consider studying options strategies, risk management techniques, and consulting with a financial advisor or professional for personalized advice.

With the legalization of cannabis in 21 states and the district of Columbia, the legalization movement continues gaining traction in the United States. Along with this progress, the passage of the SAFE (Secure and Fair Enforcement) Banking Act is another step towards unlocking the multi-billion dollar industry of cannabis legalization. In this blog post, we'll be looking at the timeline and importance of the SAFE Banking Act in the quest for nationwide legalization, as well as the history of the cannabis legalization movement. What is the SAFE Banking Act? The Secure and Fair Enforcement (SAFE) Banking Act began as a stand-alone bill and was first proposed in 2013. Most recently, the SAFE Act of 2022 has been added as an amendment to the National Defense Authorization Act. This amendment protects financial institutions that offer services to legitimate cannabis-related businesses. It aims to reverse current laws that prohibit financial institutions from providing services to cannabis-related businesses. It will allow the issuing of loans and extending credit to cannabis-related businesses that did not previously have access. It will also help ensure that those working in the cannabis industry have access to legal counsel. The Safe Banking Act was approved by the House of Representatives in June 2022 and is now awaiting further action from the Senate. This act is an important step in the quest for nationwide legalization of Cannabis, as it would give banking access to businesses in the industry. If passed by the Senate, the bill will be sent to President Biden for approval and implementation. As the nation continues its march towards nationwide legalization, this is an important step forward in removing barriers for businesses in the cannabis industry. Importance of the SAFE Banking Act in the quest for nationwide legalization Cannabis has been a controversial topic for many years, but in the last few decades, a significant shift has been taking place in public opinion and acceptance. Many states have started to recognize and legalize cannabis for both medical and recreational use, and the movement continues to gain momentum. With the SAFE act one step closer to being passed, cannabis is one step closer to becoming a legal industry nationwide. This crucial step towards nationwide acceptance will allow businesses to access the banking system and allows them to process payments and access funds without fear of criminal or civil liability. This will help open up the multi-billion dollar industry and unlock its growth potential. Canopy Growth Corporation Canopy Growth Corporation, (Ticker: CGC,) is a Canada-based cannabis company founded by Bruce Linton and Chuck Rifici in 2013. The company was given the name Canopy Growth Corporation in 2015 and became the first federally regulated, licensed, publicly traded cannabis producer in North America. Canada's first legal cannabis sale was made at midnight by CEO Bruce Linton in St. John's, Newfoundland. The Canopy Growth Corporation and the cannabis industry as a whole have been making waves in the stock market. Investing in Canopy Growth provides a safe way to capitalize on the opportunities presented by the SAFE Banking Act and the potential for nationwide legalization of Cannabis. With the SAFE Banking Act approved by the House of Representatives, the timeline to move it to the Senate is looking promising. As one of the most established companies in the legal marijuana industry, Canopy Growth is perfectly positioned to take advantage of the financial opportunities that nationwide legalization would bring, making it a safe investment for those looking to cash in on this booming market. How to Learn More If you want to learn what other cannabis companies should be on your watchlist, the Brown Investors Cannabis Investment Guide is a must-have! With the Brown Investors Cannabis Investment Guide, you can get up to speed on what's happening with the Safe Banking Act and gain valuable insight into which cannabis companies should be on your watchlist. Contact us to joing the membership and learn how to make informed decisions about where to invest!

A short squeeze can generate huge returns, but investors must know how to spot it and employ the right trading strategy. It is one of the most controversial and popular topics among traders. This is because it has a potential for high losses or profits depending on which side you are on. This article will explain short squeezes and how they relate to float and volume. What is a Short Squeeze? A short squeeze is an unusual market phenomenon that happens when traders bet that a stock will fall, but it rises instead. This rise in stock prices forces many short sellers to close their positions to cut losses. However, this move pushes the price even higher. In short-selling, investors borrow stock and then sell it, hoping to profit by repurchasing it at a lower price. This phenomenon begins when a heavily shorted asset rises in price unexpectedly. Since short sellers close their positions by buying, their exit pushes the prices higher. What is the Float? Float is the total number of shares available for the general public to purchase and sell. It excludes the restricted stock that insiders hold. But, if insiders sell their stock in the market, it becomes part of the float. A company's float is calculated by subtracting the restricted stock from the company's outstanding stock. Restricted stock is stock under a lock-up period, and thus investors cannot buy or sell it. The company is not responsible for how the investing public trades shares within the float. Floats can help investors understand a company's ownership structure. Restricted shares indicate the level of control insiders have. What is Volume? Volume is the total quantity of stocks, shares, or contracts buyers and sellers exchange for a specific asset or security. It is measured on stocks, contracts, options, bonds, futures contracts, and other commodities. The trade volume measures a market's liquidity and activity during a specific period. A higher trading volume shows buyers and sellers transact more shares for a particular asset during a specific period. It means better order execution and more liquidity and is thus better than lower volumes. The Relationship Between Float and Volume Low-float stocks are generally more volatile than stocks with high float. This is because it is hard to find buyers or sellers with few shares available, leading to a low trading volume. The increased volatility of stocks with a low float makes them ideal for day trading. They provide excellent opportunities for position trading or scalping. However, this doesn't mean that investors automatically trade them; they must consider other factors. When the trading volume exceeds the float, it means that a trading catalyst is causing a high buying and selling activity. This trading phenomenon is common with companies with low floats and tends to appear during important events. Events that can boost the trading volume include an initial public offering (IPO), a takeover bid, or an announcement of corporate earnings. Such events can cause the stock price to go up exponentially. How Low-Float, High-Volume Stocks Experience Short Squeezes Low-float stocks are some of the most volatile and have potential short-term gains if they experience a short squeeze. Since these stocks have fewer shares trading, an imbalance in demand and supply can skyrocket the share price. Likewise, the price can fall as quickly as it can rise, making them riskier. Stocks with low float and high volume can be challenging to short. This is because they are hard to borrow and can incur a cost. Moreover, they need higher maintenance margins and borrowing rates. Short sellers are often trapped when there are no more shares to borrow. This forces them to chase stocks even higher in the open market, triggering a short squeeze. Conclusion Short squeezes accelerate stock prizes, presenting opportunities for investors to grow their portfolios. Contrarian investors anticipate this phenomenon and buy these stocks. If you are interested in short squeezes, join our membership and the conversation.

DBV Technologies is a biopharmaceutical company that focuses on developing treatments for food allergies. The company is based in Montrouge, France, and is known for its innovative approach to treating food allergies through the use of its proprietary Viaskin technology. This technology involves delivering allergens through the skin, rather than through oral consumption, to desensitize patients to the allergens and reduce the likelihood of allergic reaction. Viaskin Peanut, Viaskin Milk, and Viaskin Egg make up DBVT's line of allergic treatment products. The emergence of the infringing allergen into the bloodstream could lead to serious or life-threatening allergies, among other anaphylactic shocks. Therefore, this technology treats patients, like children and infants experiencing severe food allergies, as safety is a top priority for these patients. DBV Technologies Brief Background In 2002, Dr. Pierre-Henri Benhamou, engineer Bertrand Dupont from Paris' Arts & Métiers ParisTech, and Professor Christophe Dupont formed DBV Technologies. Together they funded the inaugural start-up budget. However, between December 2003 and January 2011, DBV Technologies secured venture capital worth about €40 million. Again, NYSE Euronext's initial public offering in March 2012 brought around €40.5 million (Euros). Currently, Pascal Wotling is the Chief Technical Operations Officer, and Daniel Tassé is the Chief Quality Officer. DBVT’s Viaskin Peanut Patch & the FDA Approval In August 2020, the FDA sent a Complete Response Letter (CRL) that aligns with DBVT's Biologics License Application (BLA) for Viaskin Peanut (DBV712 250 g). An experimental, non-invasive, once-daily epicutaneous patch to manage peanut allergy among children aged 4 to 11 years. DBVT addressed the requirement for patch revisions, which was the FDA's primary concern raised in the CRL, as a viable remedy. The FDA consented to DBV's assertion that a revised Viaskin Peanut patch may be a suitable strategy, so they did not regard it as a new product element. However, this was conditional as the patch's occlusion chamber and the peanut protein dose of 250 g (roughly 1/1000 of a peanut) stayed the same and worked as intended. Once again, DBV notified the FDA of its intention to start a pivotal Phase 3 clinical research in the targeted age group for a modified Viaskin Peanut patch, VITESSE, in the 4th quarter of 2021. The existing Viaskin Peanut patch is rectangular, whereas the modified patch is circular and is about 50% bigger. Notably, the EPITOPE research included the square-shaped current VP patch. For upcoming regulatory or BLA developments using the EPITOPE data, DBV may continue using the current VP patch. FDA Demands The FDA asked for adjustments to the VITESSE guidelines in the Partial Clinical Hold (PCH) letter, such as: An upsurge in trial subjects receiving active treatment. Inclusion of a statistical test for patch adherence evaluation. Reclassification of a few negative incidents as negative incidents of unique interest. Minimum daily wear time changes. After the FDA imposed a hold in September, it verified DBV has successfully resolved each clinical hold problem mentioned in the PCH letter before dropping the PCH. This made DBV Technologies' (DBVT -2.14%) stock rise by 19% only after it disclosed that the FDA partially withdrew a clinical hold on late-stage clinical studies. DBV intends to start different safety research with about 275 extra participants. However, the added safety research may not influence the company's financial runway estimate. DBV also expects to screen VITESSE patients in the initial quarter of 2023, with the last screening in the second half of 2024 and findings expected in the third quarter of 2025. Invest with Brown Investors Today At Brown Investors, we seek to expand financial literacy reach, while also providing investment tools and portfolio management for generational wealth creation. Contact us today for more details on how to become a member and let us help you find a promising investment.